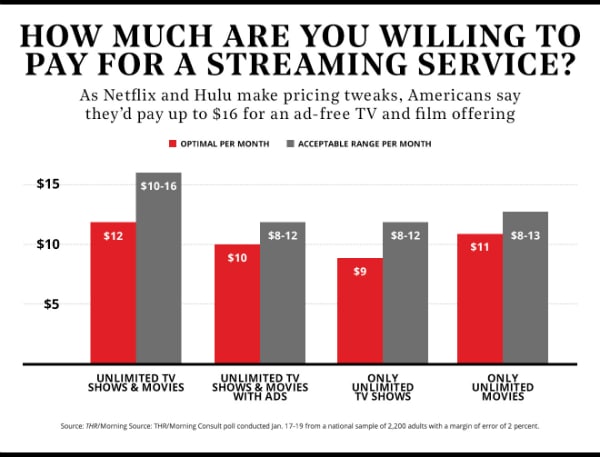

Americans say the acceptable range for a service offering unlimited TV and movies with no ads is $10 to $16, a Hollywood Reporter/Morning Consult poll finds.

The marketing teams for the major upcoming competitors to Netflix have some more work to do: despite a plethora of news stories about them, about 40 percent of American adults still don’t know that WarnerMedia and NBCUniversal have subscription services in the works while 30 percent are unaware of a Disney product dubbed Disney+, according to a new Hollywood Reporter/Morning Consult poll.

Meanwhile, some analysts are increasingly skeptical that the newcomers, even though they come courtesy of giant entertainment companies with plenty of content to deliver, will have much luck overcoming the huge first-mover advantage that Netflix enjoys with its 139 million worldwide subscribers.

Moreover, Netflix added 5.4 million subscribers in the U.S. in 2018, more than any year since 2013 when it added 6.3 million, notes BTIG analyst Richard Greenfield. This despite significantly more competition than back then, with Amazon Prime Video, Hulu, CBS All Access and HBO Now also clicking with consumers in a significant way nowadays.

Netflix “reaching 80 million U.S. subscribers no longer sounds crazy the way it did a few years ago,” says Greenfield, and that spells trouble for those who are coming late to the streaming party.

According to the THR/Morning Consult poll, which surveyed 2,200 adults from Jan. 17-19, Netflix is pushing the limits of its pricing power. Its most premium offering, a $16 product, is at the top end of what survey respondents say the “acceptable range” for a service with unlimited movies and TV shows is, at $10-$16 monthly. NBCUniversal’s streamer to debut in 2020 will have commercials, and the poll indicates an acceptable range for such a service is $8-$12, though Comcast cable subscribers will get it free, at least at launch.

(Excerpt) Read More at: HollywoodReporter.com